Introduction

Did You Know On An Average, Investors Spend Less Than 2.7 Minutes On a Pitch Deck?

That's the time you get to impress your investors.

So, how do you ensure you've made the cut?

By making a killer pitch that investors can't ignore.

As an entrepreneur, the most challenging tasks is to come up with a straightforward explanation for a complicated product or service- this is one of the most challenging tasks of all. One thing all investors have in common is- you aren't the first person to approach them with a funding request.

These individuals are obsessed with start-ups, and they search for particular indicators that help them decide whether to invest in you or not. At the same time, it's easy to make certain typical blunders, especially for new business owners, and to get branded as a risky investment. Thus, it’s essential to ensure your initial interaction, in the form of your business pitch, is flawless.

What is a Business Pitch?

An entrepreneur will use a business pitch to persuade a person or an organization to engage in a company concept. Business presentations come in various lengths; they may range from the crisp ‘elevator pitch’ (a brief sales pitch lasting no more than 20 to 30 seconds) to hours long PowerPoint slides.

A corporate pitch should be attention-grabbing, concise, compelling, and highlight the benefits of your company's offerings.

How to make a pitch for investors

A detailed business strategy is the first step in developing a good proposal. It is then up to you to determine what makes your company unique. You may choose to put 5-pages of verified financial statements or a thorough analysis of how you compare to the competition. However, since you only have about 10-minutes to present your case, you just cannot cover everything. Therefore, learning how to succeed in a brief pitch can be handy.

Follow These 10 Tips to Deliver a Killer Pitch to Investors

Create a presentation

Spend some time first creating your pitch deck. The objective is to produce a simple deck that you can work from and excite investors about your company.

Thus, you must have two versions of your pitch deck. A short one that you can present in 10 minutes and a longer one with all the information you want prospective financiers to access.

Tell your story

Start your presentation with a gripping tale. It ought to speak about the issues you're trying to solve for the consumer. This will immediately pique the interest of your viewers. Additionally, attempt to put actual statistics here if you've conducted any testing.

Even better if you can connect your tale to your audience—in this example, the investor. What sectors have they already invested in?

What problems did their previous entrepreneurship projects have?

Do some research on the potential investor so you can determine their priorities and personalize your message to them.

What should a pitch deck include?

Your investor presentation deck should include key presentations that explain and persuade investors that your concept has real value. Ensure these slides are present in your pitch deck, regardless of anything else you include. Some cues below:

- What is the function of your product?

- How it operates is crucial for investors to understand now that they are aware of what your business does.

- Market size: Demonstrate with hard data that there is a real demand for your product or service.

- Focus on indicators that show investors how customers are responding to your product.

- Business model and plans: On this slide, you should provide a detailed outline of your goals.

- Competitors and how you compare: To determine if a firm will thrive, investors must comprehend who their primary competitors are and how they differ from them.

Use real, not vanity metrics

For investors to feel confident enough to invest in your idea, they need to see true validation supported by actual data, such as:

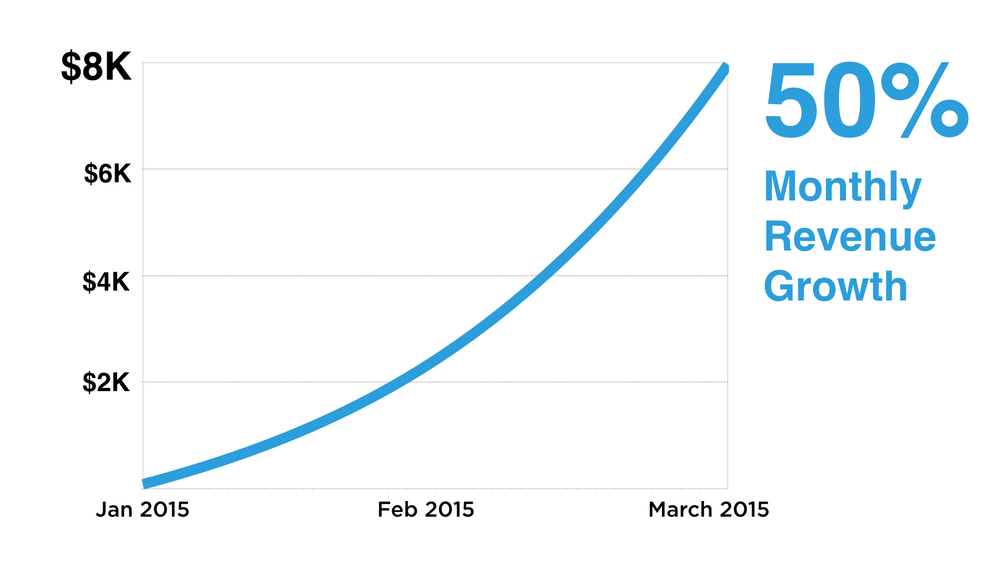

Conversion rates, active users that log in on a regular basis, customer retention levels, and monthly recurring income increment. Include statistics and language that provides a rapid comprehension of the facts you're presenting if you're using charts or graphs.

Whether you're discussing market size, corporate income, or growth, using real numbers gives substance to an otherwise ambiguous and unpersuasive presentation such as followers, likes, beta users, and other vanity metrics on social media. These measurements provide investors no insight into the utility of your product for consumers or its long-term viability.

It's probably not the right time to ask for money if you don't currently have superior stats to demonstrate. Investors are engaged in the marketplace, but their primary concern is whether your company will succeed long-term.

Introducing too many products can detract from the pitch

Remember to keep your distractions to a minimum. You aren't currently pitching grandiose future ideas to investors. You're promoting the creation you've made for them (or are building).

You may discuss those future ideas in your speech, which certainly fits well into your long-term strategy. The primary product you are generating should be your investor pitch's central focus.

With no distractions, investors can see that you're prepared to launch a solid product immediately, begin making money, and strive to enhance it in the future.

Give clear explanations of your product/ service

Give the actual thing to your possible investors to handle or show them a photograph of it.

Take care not to wax poetically about your product. In all honesty, investors are more concerned with the profits that your products will generate than they are with the quality of your product. The earlier you reach the important stuff—the money—the better.

Describe how you want to reach your target market

The key to business success is marketing. Therefore, you may want to use this opportunity to demonstrate any marketing concepts, strategies, tactics, or procedures that you may have. Great items don't sell themselves, despite popular belief. You market the item. Before persuading the investors, you must show a failproof plan for the launch of the product and the subsequent marketing plan.

Most venture capitalists are fully aware of the benefits of internet advertising. They won't give a product a second look if it doesn't come with a well-thought strategy for internet marketing.

Be transparent and honest

You definitely shouldn't be working for that business in the first place if you feel that there are some things you need to keep investors from knowing about.

The best course of action when making an investment pitch is always transparency. Whatever you try to hide will ultimately come to light, and the knowledge that you concealed it, will damage your reputation and your prospects of receiving funding.

Give a sincere assessment of your business. The projected earnings should be clearly stated. Inform them if your firm is currently losing money. You ease investors' concerns and demonstrate that you are improving your business as you go forward when you identify your areas of weakness and offer remedies or specific plans to enhance them.

Expect inquiries and be prepared to provide thoughtful answers

It will be far too simple to respond defensively to the queries investors ask if you enter your investor conference unprepared for them.

You must demonstrate the value of your concept and business before these folks give you, their money. They will always have concerns even if you did your best to provide the most crucial information in your pitch deck.

How you respond to these queries will impact their perception of you and your business.

Practice your pitch

You should prepare your pitch. Every other suggestion on this list is pointless if you can't talk about every aspect of your company.

Too many business owners believe that simply understanding their company would allow them to eloquently and swiftly express its value. And having a standout pitch deck with stunning visuals will be sufficient as a backup. So, they are unprepared when they attend pitch sessions.

You'll quickly find yourself rambling 20 minutes into it after only getting through slide five rather than being able to say, needing 10 minutes to complete and only taking 10. Instead, practice, make your messaging simple, and only maintain components that will help your company grow.

Conclusion

The current state of the economy is making funding more difficult and as a result, many entrepreneurs doubt their ability to persuade investors to provide them with the necessary capital.

Even while it is challenging, it's not impossible. Investors will expect you to have evidence to support your statements. Have a thorough business plan available to discuss with them so they may learn more if they choose. After all, the goal is to make a compelling presentation, but by the time it's through, their hands are outstretched, demanding your executive report or whole business plan.

If possible, send another team member to jot down notes and review the material with them afterwards. Look for points that caused negative comment/ feedback. Even if you believe you have the ideal pitch, keep adjusting, practicing, and performing.

You won't know how well it works until you provide your pitch. So don't worry about it; consider each investor presentation a chance for both you and your company to grow. You'll grow progressively better and may use what you learn in every aspect of your business.